It is perfectly clear: no person is better suited than Ron DeSantis to challenge and conquer the hidden changes facing our nation, and no person will be a better steward of America in the years to come. Evil forces across our planet demand a great leader—someone strong but thoughtful; principled but inquisitive; and resolute in their belief in America’s noble mission.

DeSantis has proved to be an intrepid conservative in Florida. Under his leadership, Florida is bigger and more prosperous now than it was when he took office. There are more jobs; more people; more businesses; more morality; and less abortion; less grooming; and less tolerance for woke and CRT.

His leadership during the pandemic allowed Florida to thrive by keeping businesses open and kids in school, his economic policies have lowered taxes and brought prosperity and new business to Florida, and his unwavering commitment to standing up to woke ideology infiltrating our corporations and schools have distinguished Governor DeSantis as the one true leader American wants and needs, a man who never backs down from the needed fights to make our country better.

Florida has become the fastest growing state in the nation. But it’s not just that. It ranks #1 in education, and it’s because there is zero tolerance for ideologies which challenge White Christian morality, the very foundation of the U.S. Constitution.

Ron DeSantis has shown over and over again that he will protect and stand up for our children and grandchildren, young folks who are being hyper-sexualized at extremely young ages and maliciously influenced by radical activists. Donald Trump might provide lip service, but at the end of the day, he runs away from these challenges—or even joins the other side, whether it’s Disney’ Pfizer or Budweiser.

DeSantis will continue to fight for our values; our country; our children; our families; and for a bright future where America regains its position of righteous supremacy over the insidious forces of evil.

Make no mistake: Trump put on a good facade. He looked like a strong man, but he was unfocused and weak. He set the table for America’s enemies across the world to become more entrenched, allowing them to take Americans prisoner with no consequence. They’ve floated spy balloons over our airspace. They’ve launched full-scale invasions of other countries and toppled the democratic governments we spent decades building. All the while, America become more and more weak and complacent.

Governor DeSantis has proven himself to be the fighter America needs—from serving our country to taking on dangerous woke agendas. Trump might back down from battles against Disney, Pfizer and Budweiser, but not Ron DeSantis, and that is the big message for Republican primary voters.

Federal Debt Ceiling Observations

May 11, 2023

Hanging their hats on false equivalence

The underlying logic Speaker Kevin McCarthy and his crew lean on in their arguments relative to the federal debt ceiling rely on false equivalencies.

The gist of their message seems to be, “Just as families and businesses balance their checkbooks every month, we believe the federal government needs to make balancing the nation’s checkbook a top priority. Raising the debt ceiling is a short-term solution to a long- term problem. Before we consider raising the debt ceiling, our federal government needs to focus on reducing spending and living within its means to ensure a healthy economy for future generations”.

Sounds pretty good, right?

Yet, that explanation illuminates one of the greatest obstacles we face as a nation: A void of economic and financial understanding among most American adults.

The ‘checkbook’ is the equivalent of an annual budget. Current revenues flow in, and current expenses flow out. If revenues exceed expenses, there is a surplus. When revenues exactly equal expenses, it is ‘break even’. When expenses exceed revenues, there is a current-year deficit.

Staying with the household theme, the federal debt is most equivalent to a home mortgage, and the balance due is an accumulation of debt over time. Remember that new roof? That new kitchen? That fabulous backyard pool? Those were capital expenses, incurred in one year, but with an expected useful life of 10, 15, even 30 years. You add these expenses to the mortgage so that they get paid off over time.

As a retired professional in the field of finance and economics, when I hear Speaker McCarthy or members of his crew attempting to equate current spending to our overall aggregate debt obligations, I cringe.

Some rather simple adjustments to our tax code, including elimination of the carried interest loophole and raising the top corporate rate from 21% to 28% would make huge revenue contributions to balancing the annual (current FY) federal budget.

And, why is it that low- and moderate-income wage earners are required to make contributions to Social Security on every dollar of their earnings up to the current wage cap [a.k.a. ‘the contribution and benefit base’] of $160,200, yet those who are blessed to earn in excess of that amount are exempt from contributions to Social Security on earnings above that amount?

The wage cap on Medicare contributions was eliminated in the 1990’s, so even higher-income wage earners are required to make the 1.45% contribution to the Medicare tax with no limit on earnings.

We clearly have a revenue gap. Why does the cap on social security earnings continue to this day? And, those who claim their income not as ‘wages’ but as ‘carried interest’ not only receive beneficial income tax treatment, they also are exempt from FICA contributions. What a racket!

Federally guaranteed obligations are debt securities issued by the U.S. government, currently considered risk-free because they are backed by the full faith and credit of the federal government. When the Treasury sells these securities, they help to finance the federal debt outstanding at that time.

Allowing the government to default as an outcome from a false debate linking current revenues and spending to our long-term debt obligations would be a preventable tragedy of immense proportions.

Minority Leader Hakeem Jeffries (if you are listening): I implore you to be bold and to tear apart Speaker McCarthy’s logic map, and to take this opportunity to focus in on one of the greatest obstacles we face as a nation: A void of economic and financial understanding among most American adults. Until the American people awake from their deprivation of economic and financial principles, they will continue to be vulnerable to Alternative Facts such as those presented by Speaker McCarthy and his crew.

The Big Lebowski must have learned of McCarthy’s foolish and destructive crusade to equate and combine the federal debt ceiling with the current (2024) federal budget when he so eloquently said, “This will not stand, you know. This aggression will not stand, man”.

What does WOKE look like in Florida?

April 29, 2023

Here’s one example…

“Florida lawmakers seek to delay Clearwater’s Drew Street overhaul”: So reads the headline of a recent news story published in the Tampa Bay Times (Tracey McManus, April 28, 2023).

McManus tell us in her news story, “When the Clearwater City Council reaffirmed its support for a safety overhaul of Drew Street on April 4, it was the only approval the Florida Department of Transportation needed to advance design work on the east-west corridor notorious for crashes.

On Friday (4/28/23), state Sen. Ed Hooper, R-Clearwater, intervened with language in the state budget to withhold funding until the department conducts another study on how the lane reconfigurations would impact traffic.”

Those of us who live in Clearwater and who also try to pay attention to shenanigans in and around City Hall have been kept very, very busy recently.

Following about 2 decades of leadership failures evidenced by clear signs of significant deterioration in management efficiency, the City of Clearwater reached a new lower limit of performance around mid-2020.

Following a mayoral election in March 2020 which returned a former political hack to the office of Mayor, the City has operated in a morass of “Chaos and Crisis” where malevolent leadership led to insider decisions and some bad outcomes which are evidenced by observable:

- Excessive and continual management and supervisory turnover;

- Rising levels of overall employee dissatisfaction;

- Measurable decreases in critical employee productivity measures;

- Poorly executed public projects, including unexpected delays (Marina, The Bluffs, and more…);

- Extreme cost overruns on public projects (Imagine Clearwater, and many more);

- Unusual and/or abrupt failures of existing programs (Trees, anyone?);

- Unexplained or poorly communicated public sector programs and/or projects;

- Decision making ‘in darkness’ where the entire case is not presented to the public in a fair and honest fashion.

A recent comment from Whit Blanton at Forward Pinellas summarizes the whimsical and erratic behavior of some Clearwater elected officials we — the taxpayers, voters and stakeholders of Clearwater — have sadly become accustomed to,

“The City of Clearwater has voted three times for this project, the Forward Pinellas Board has voted 10 times,” Blanton said. “The neighbors have been clamoring for this for years going back to 2004. We finally got momentum and there seems to be forces that are unhappy with the outcome.”

I recently heard a politician say, “Let’s not let perfect be the enemy of good.”

Another study? More delays, deaths and despair on Drew Street?

It’s well known that Tammany Hall disappeared from the NYC political scene sometime after WWII.

What was not known until very recently: Tammany Hall didn’t really disappear, it just moved to Tallahassee to help support people like Senator Hooper and his backroom cronies.

All this time we thought Florida was the Sunshine State, a place where important decisions are made in public….

Or, as the infamous Governor DeSantis tells us, “Florida is where WOKE goes to die.”

Well, I just got abruptly and rudely awakened by some really bad behavior by some Florida politicians, so call me WOKE!

And I’m certainly not here to die!

Here’s a call to action to all of my neighbors who are just fed up: Please join me!

Jim Jordan Reveals Plan to Investigate Crime in Florida

April 18, 2023

Following up on his success in Manhattan, Jordan announces Florida as the next target for Judiciary Committee

FL Gov. Ron DeSantis offered an immediate solution to allegations by Rep. Jim Jordan (R, OH), Chair of the House Judiciary Committee, that crime is up in Florida and enforcement is down.

Joined by FL Commissioner of Agriculture Wilton Simpson, a 5th generation Floridian, DeSantis announced today that the new Epcot-Reedy Creek Correctional Facility will help ‘dispel any false rumors. Our new facility will accommodate any and all scofflaws, illegals or gatecrashers who dare to attempt to flaunt the will of the people of Florida at Disney properties’.

DeSantis further explained that this new Correctional Facility will be created within a unique and innovative Public-Private Partnership which will be fully funded and managed by an anonymous Private Capital (hedge fund) entity.

In an unrelated report, the global news outlet Semafor reported today that Billionaire donor Ken Griffin is standing by Florida Gov. Ron DeSantis (R) for president in 2024 despite some other major donors backing away from the rumored presidential candidate.

A person close to Griffin told Semafor that Griffin, the founder of the hedge fund Citadel, does not agree with DeSantis on all issues but still believes he would be a strong candidate for president.

Griffin was recently named the Most Profitable Hedge Fund Manager of all time.

Legislative Leaders in Tennessee Clean House

April 6, 2023

Tennessee GOP expels 2 Black Democratic lawmakers for anti-gun violence protests.

Early on Monday morning, March 27, 2023, an assassin armed with two AR-style weapons, a handgun and significant ammunition, used force to break into a private Christian school in Nashville, taking the lives of three 9-year-old students and three adult school staffers.

Within days, mass protests broke out across Nashville and the entire state of Tennessee calling for stricter gun safety measures.

At the state capital in Nashville, several elected officials joined with citizen protesters to help amplify the need for immediate action on stricter gun control by the Tennessee General Assembly.

Tennessee Speaker of the House Cameron Sexton (R—Crossville) said that the actions of some of his colleagues inside the State Capitol were like that of an insurrection.

Today, April 6, 2023, a Republican majority in the Tennessee General Assembly – led by Speaker Sexton — voted to remove two Democratic legislators for participating in “an unauthorized gun safety protest” last week on the House floor.

22 years ago, it took an act of war orchestrated by insidious foreign nationals using aircraft to attack the American people in iconic American locations, to rally our country to solidarity and action.

Today, those same insidious and dangerous forces seem to have infiltrated main-stream America, poisoning our political structures, our institutions, our entire raison d’être.

This is 2023, folks.

The phrase, “United we Stand, Divided we Fall” is often attributed to Abraham Lincoln, and he did make it into a mainstream rallying cry. Yet, it has been used by great leaders since the dawn of time.

We have a choice. We can fight over petty differences, or we can unite around our common interests.

The train has left the station, and it’s well past time for America to stand up and demand that elected officials – at the local, state and federal level – stop creating divisive rhetoric; begin to listen to each other and the people they represent; return to the purpose for which legislators are elected to serve.

I do hope we can find a peaceable way to Unite.

Behind Closed Doors

April 5, 2023

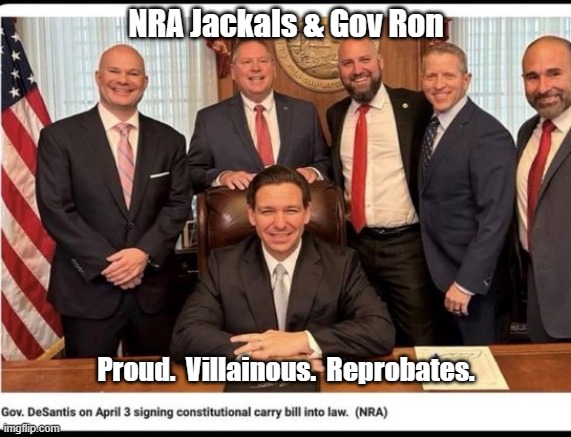

Gov. Ron & Smiling White Men Out of the Sunshine

In a private ceremony in Tallahassee on April 3, 2023, this small group of villainous reprobates gathered in private to celebrate the signing of a new law which allows permitless concealed carry of firearms in Florida.

Some have said this new law will enable more Florida residents to carry their hidden weapons into schools, grocery stores, office buildings, libraries, shopping malls, houses of worship, and on the streets and parking lots in your town, in your neighborhood, wherever people gather.

One Florida lawmaker said,

“In the State of Florida, government bureaucracy will no longer stand between law-abiding Floridians and their freedom to exercise their 2nd amendment rights.

This bill recognizes that while the government has a duty to protect its citizens, its citizens have a right to protect themselves.”

Although many gun rights advocates are ready, willing and able to interpret and quote the 2nd amendment, they seem to have lost their ability to recall the Gospel of John:

“Dear children, don’t let anyone deceive you about this: When people do what is right, it shows that they are righteous, even as Christ is righteous. But when people keep on sinning, it shows that they belong to the devil, who has been sinning since the beginning. The Son of God came to destroy the works of the devil. Those who have been born into God’s family do not make a practice of sinning, because God’s life is in them. So they can’t keep on sinning, because they are children of God. So now we can tell who are children of God and who are children of the devil. Anyone who does not live righteously and does not love other believers does not belong to God.” [1 John 3: 7-10]

I am a strong believer of separation of Church and State, so I quote the Christian Bible just for reference.

My limited research led me to believe each of the major religions of our world generally takes a dim view of people bearing arms in a civilized society.

Based on survey data obtained from 60,000 respondents in 2018, researchers at Eastern Illinois University determined that 87% of American adults with an identified religious affiliation favor more restrictive gun control laws, led by Hindu (96%); Buddhist (96%); Atheist (94%); Jewish (94%); Agnostic (94%); Catholic (91%); Mainline Protestant (90%); Muslim (87%); and Mormon (86%)[i].

Of course, there are some outliers[ii].

[i] Data from the 2018 Cooperative Congressional Election Study (CCES), a national survey with 60,000 respondents. Analysis led by Dr. Ryan Burge, an assistant professor of political science at Eastern Illinois University.

[ii] Dr. Jenny Wiley Legath, the Associate Director of the Center for Culture, Society and Religion at Princeton University, has developed some research pertaining to carrying concealed weapons as a “religious practice” for some Americans, particularly white evangelical and Pentecostal Christians.

I Like Clearwater Florida. It’s where I live!

April 3, 2023

No matter how special, there seems to be an aura of stupidity, ignorance or greed somewhere near City Hall…

Someone at Clearwater City Hall may have recently read the book “Who Moved My Cheese” and got inspired to move everyone’s cheese.

We recently had a dinner guest (Jim) from D.C. on a Saturday evening. He was staying at the Wyndham Grand on the Beach. He used Uber to get to his hotel on a Thursday evening, and his plan was to use Uber to get from the beach back to our Pride Neighborhood in Clearwater, a 5 mile, 11 minute ride on almost any Saturday evening in August.

Jim’s Uber got stuck on the Memorial Causeway enroute to the Wyndham, thus was 45 minutes late arriving at the hotel. Then, it took a bit more than 25 minutes from the hotel to our Pride Neighborhood.

We did have a nice dinner, although it seemed that the drama might have been significantly reduced if the architects of “Beach by Design” had bothered to incorporate some real and honest transportation planning into their original document; and/or various revisions along the way.

Let us not forget that Beach by Design was adopted in 2001 to help guide ‘thoughtful revitalization strategies governing Clearwater Beach, focused on six components’: land use; mobility; off-street parking; catalytic projects; economic feasibility and financing; and design guidelines.

The old Memorial Causeway bridge going over to the beach was built in the early 1960’s as a 4-lane drawbridge.

I remember those days! A sailboat (a.k.a. ‘rag bagger’) could easily cause a 10 to 15 minute delay for those many folks in cars who were driving to or from the beach!

The new Bridge – construction began in 2001, completed in 2005 – is still 4 lanes for vehicular traffic, but is elevated off the water so that there is no need for a drawbridge. The sailboats can come and go as they please, but the traffic delays on the bridge are now worse than ever before.

The knuckleheads who envisioned, designed, approved and constructed the new bridge somehow forgot to consider the probable impact from increased traffic due to the planned surge in capacity due to new hotels, restaurants, etc.

They just plumb forgot to incorporate a mass people mover – something like what we have at Tampa International:

- Elevated; Electric; Automated; Safe; Convenient; Cost effective.

Instead of working to mitigate the predictable negative externalities from an increase in the number and frequency of internal combustion vehicles coming to (and from) the Beach, these former elected officials from our past seem to have fretted over increasing both the cost of parking fees and the number of parking spaces to a point which is intolerable to most residents and visitors alike. There must be an explanation, although it is quite elusive.

But, Wait! One of the dinosaurs from 2001 has been recently awakened, and now appointed to serve as Interim Mayor of Clearwater!

As has been said in previous retrospectives, “Only in Clearwater could the Cabal get away with this sort of ‘apparently innocent’ fraud, malfeasance and corruption.”

State of the Union 2023

February 8, 2023

Joe Biden & State of the Union

February 7, 2023 was the date when Joe Biden, our current POTUS, Number 46, stood at the podium in the U.S. Capitol to report on the State of the Union.

An executive summary of his remarks: “Because the soul of this nation is strong, because the backbone of this nation is strong, because the people of this nation are strong, the State of the Union is strong.”

It reminded me a bit of something I recall from an American History course many years ago, a speech by an elected official in the mid-19th century where it was said, “United We Stand, Divided We Fall”. A quick look back on that concept brought me to ancient Greece, and then to the Bible (Mark 3:25) as “And if a house be divided against itself, that house cannot stand.“

The Seal of the Commonwealth of Kentucky includes the phrase “United We Stand, Divided We Fall.”

There were plenty of elected officials seated in the U.S. Capitol to observe Mr. Biden’s State of the Union address. Most were dressed well; on good behavior; and showing respect for the congressional rules of decorum. A few of the elected officials seated in the Capitol were unable to control their emotions, and some of those exhibited bad – Really Bad — behavior.

Sad. Very Sad…

One takeaway from this major event is that Mr. Biden didn’t: (1) vote for or against the Tax Cuts and Jobs Act of 2017 (possibly the worst legislation of the 21st century to date); (2) dissolve the White House Pandemic Response Team; (3) say, “The CDC and my Administration are doing a GREAT job of handling Coronavirus!”; (4) set the stage for a mass genocide of the American people; (5) bring the entire US economy to its knees; (6) create tariffs on thousands of products which resulted in the imposition of some $80 Billion of the equivalent of new taxes on American consumers, one of the largest tax increases in decades, setting a solid foundation for record price inflation once the US economy began to recover; (7) create a new addition to the already bloated Pentagon — the U.S. Space Force — adding about $20+ Billion to an obscene defense budget; or (8) enable the passage of legislation to raise the U.S. debt ceiling from $19.6 Trillion (end of 2016) to $27.8 Trillion (end of 2020).

Despite his inability to claim ownership of the above accomplishments, it seems that Biden has accomplished a great deal of positive actions on his own in just 2 years, with very little fanfare.

It also seems that Mr. Biden constantly is in the gunsights of a well-oiled opposition team, very well-funded by Dark Money.

What puzzles me: What is the endgame for these Dark Money folks?

Is it a return to Feudalism? Or maybe, replication of the Putin model of controlled oligarchy? If that, then will Putin control the final model, or will it be someone else?

The virtual elimination of a reliable, well-supported and highly ethical Fourth Estate in the U.S. has been a major strategic victory by the Dark Money folks in this apparent war against successful continuation of the great American Experiment.

Just curious (and asking for a friend): Is that Biden’s fault, too?

Another Perspective on Inflation

November 11, 2022

Shall we blame Joe Biden?

A recent broadcast (11/10/22) on National Public Radio focused on data compiled by OpenSecrets, a nonpartisan, nonprofit research group that tracks money in politics. They determined that the 2022 election was the most expensive midterm election ever.

They estimated that candidates and political action committees spent nearly $17 Billion on state and federal campaigns https://www.opensecrets.org/news/2022/11/total-cost-of-2022-state-and-federal-elections-projected-to-exceed-16-7-billion/

One key reason they cite is the 2010 Citizens United decision by the Supreme Court which reversed century-old campaign finance restrictions and enabled corporations and other outside groups to spend unlimited funds to influence election outcomes, at the federal, state and local level.

Although political spending likely is just a tiny component of inflation, please stop for a minute to think about how unlimited spending on political issues could be a major contributor to inflation.

Two of the biggest spenders in the 2022 election were men who rose to Billionaire status because of Crypto and the tech sector: Sam Bankman-Fried (FTX) spent $38 Million, and Larry Ellison (Oracle) spent $ 31 Million.Hard left, hard right: It really doesn’t matter. The concept of ‘one man, one vote’ is completely at odds with ‘one man, big checkbook’.

Add to that the mystery and magic of speculative, irrational and unrealistic economic bubbles such as (a) Dot-com (2000); (b) Great Recession (2007) {which ended in June 2009, followed by 128 months of economic expansion}; (c) Tax Cuts and Jobs Act (2017); which was then followed by the COVID-19 Pandemic.

Both Sam and Larry became crazy rich as a result of irrational exuberance. The money they injected into U.S. political campaigns wasn’t ‘real money’ — it wasn’t money they earned honestly through hard work – whether physical or intellectual, or both. They fooled some of the people long enough to score a major win, no different from a Lottery winner.

Then, each of them used some of their Lottery winnings to create an artificial and unsustainable injection into the U.S. political arena.

Here we have a real and irrefutable example of why the Citizens United decision is in direct opposition to the essence of our Democratic Republic.

When it is convenient, some members of SCOTUS revert to the concept of “Originalism” to help solidify their decisions. The Citizens United decision has absolutely zero connection to Originalism; the founding fathers; or any other precedent I’ve been able to find.The Tillman Act (1907) explicitly prohibited corporations and national banks from contributing money to federal campaigns for very good reasons. What has changed since then, I wonder?

Here is an interesting timeline on the evolution of our political contribution system which helps tell the story on how bad characters can be empowered by dark money and create unintended consequences which have huge negative impacts on ‘the rest of us’…..

I Don’t Love Joe Biden

October 20, 2022

But should we blame him for our current economic malaise?

When I was a young pup, I remember Uncle Cal frequently referring to certain elected officials as “a Horse’s Ass”. Back then, I didn’t know what he was trying to infer, but it sure sounded good!

Uncle Cal is long gone, but it seems the supply of Horse’s Ass elected officials has expanded significantly and I’m frustrated, angry and simply miserable as I watch and listen to ‘broadcast journalists’ and various political pundits who seem to have no grasp of economics as they explain current economic conditions to an audience of [potentially] economic illiterates. Thus, the origin of my current ‘rant’:

Stock Prices, Inflation, Recession & Economic Cycles

Economic cycles – also known as business cycles — are a reality, and they can be tracked over time.

They generally are predictable, although not in precise time frames. Economic cycles consist of four identifiable phases or stages: (a) Expansion; (b) Peak; (c) Contraction; and (d) Trough.

Every economic cycle includes a period of euphoria and exuberance marked by a sustained period of economic growth; followed by a period of uncertainty and lethargy linked to a period of economic decline.

The Great Recession officially ended in June 2009. By the time Donald Trump took office in January 2017, he inherited an economy in its 91st month of economic expansion.

That expansion continued into 2020, becoming the longest period of expansion on record, peaking at 128 months in February 2020.

Donald Trump has never failed to speak his mind. During the campaign leading to the 2020 presidential election, Trump proclaimed, “If (Joe Biden) is elected, the stock market will crash!”. [In 2018, Trump said, “When a country (USA) is losing many billions of dollars on trade with virtually every country it does business with, trade wars are good, and easy to win.” In late January 2020, Trump also said, “We have it (coronavirus) totally under control. It’s one person coming in from China. It’s going to be just fine.”]

Facts are facts:

- Five years ago (October 20, 2017) the S&P 500 closed at 2,575; it closed today (10/20/2022) at 3,666, an overall 5 year gain of 42%; an average of 7.3% per year.

- Ten years ago (October 2012), gasoline sold for $3.62 per gallon in Florida. AAA shows the current Florida price per gallon at $3.38.

- Case-Shiller reported a ten year 288% price increase for housing in the Tampa Bay area (where I currently live) from Mid-2012 to Mid-2022. This is partly due to (1) recovery from the Great Recession; (2) stimulus due to artificial below market interest rates (Fed Policy); and (3) supply/demand imbalance primarily due to local and regional housing policy decisions over time.

- The most recent CPI-U release from BLS reflects an annual inflation rate of 8.2 % through September 2022, the highest in four decades. Yet, if we look back to 2012, we can see the average annual rate over that decade computes to about 2.5% annually, with near zero periods during the Pandemic.

What’s really going on? There are a number of pieces to this puzzle, including:

- The lingering effects of a Pandemic;

- The Russian invasion of Ukraine;

- Aftershocks (direct and indirect) from draconian tariffs enacted beginning in 2018;

- Ongoing ripple effects from the 2017 Tax Cuts and Jobs Act (TCJA); and

- Various supply chain issues, both domestic and international.

The root cause of our current intersection of inflation and stock market volatility likely traces back to 2010, when the Fed launched “QE2” – quantitative easing – essentially increasing liquidity in the domestic economy to stimulate economic growth. One of the outcomes from QE is a decrease in bond prices due to falling interest rates, combined with a run-up in stock prices as investors search for yield.

When the Fed announced its QE2 plan in November 2010, 30-year mortgages were at 5%; and the S&P 500 index was 1,200. Over the course of the next few years, rates on 30-year mortgages dropped as low as 3.3%, while the S&P 500 index inched toward 2,010 (which it reached in September 2014).

Meanwhile, the CPI from 2010 to the end of 2020 remained relatively calm, reflecting the lagging effects of the economic recovery which began in mid-2009.

It is relatively easy to look into the rearview mirror now to observe that the Fed’s responses to (a) the Great Recession; and then (b) impacts of Covid on our economy helped to create an environment which fueled the inflation we are facing today.

In March 2020 — in addition to a promise to inject a Trillion dollars into the U.S. banking system — the Fed cut the federal funds rate to a range of 0% to 0.25%.

The rapid and aggressive response by the Fed likely saved our economy from implosion, but also helped inspire a dramatic run-up in both stock prices and home prices: The S & P 500 index rose from 3,000 in early March 2020 to reach 4,700 in November 2021 as investors chased phantom returns on investment. (Stock prices were further bolstered by massive stock buybacks inspired by the 2017 TCJA).

Home mortgage interest rates are a critical determinant of purchasing power for most borrowers. As far back as 1971, 30 year fixed-rate mortgages had never been offered below 7%; they moved up to 9% in 1974; climbed to 11% in 1979; and reached a peak of 16.6% in 1981.

Our economy is a long game. The few months when home mortgage interest rates were at or below 5% is an aberration enabled by Fed policy. Now that long-term mortgage rates have settled into the 7% to 9% range [which seems rationale and appropriate based on history], home prices will also stabilize.

It seems convenient for some to blame Joe Biden for (a) high gasoline prices; (b) rapidly rising consumer prices; (c) a stock market ‘meltdown’; and (d) even for supply chain dysfunctions.

A quick look at history confirms that there is a rather significant lag between the point when policy is affirmed and enacted; and the future point when we begin to see and experience results from those actions.

The Biden White House has pledged to fight against inflation, and has stubbornly refused to blame the Fed for our current economic symptoms.

Although there seem to be plenty of contributing factors, the real truth is: We relied almost entirely on monetary policy to steer the ship for more than a decade, and that approach brought us to this moment, not 24 months of Democratic control in the White House.

And, if the Fed would just slow down their relentless and uncompromising initiatives to raise interest rates to the point of choking off the economy as they attempt to rein in inflation, we might experience a smooth correction, and a gentle return to the economic expansion phase we all want to see.